What You Should Know:

– Deloitte’s 2026 US Health Care Outlook reveals a dangerous disconnect: while nearly 70% of health executives expect to outperform competitors next year, the “traditional playbook” of market expansion and cost-cutting is no longer sufficient.

– Amid rising regulatory uncertainty and financial pressure, the report identifies three mandatory pivots for survival: empowering consumer health with digital experiences, scaling generative and agentic AI across operations, and forging cross-industry alliances. Leaders who fail to embrace these transformational shifts risk falling behind in a rapidly evolving landscape.

Why 2026 Will Break the Traditional Healthcare Playbook

For decades, the path to success in American healthcare was relatively linear: acquire more facilities, negotiate better rates, and incrementally improve efficiency. But according to Deloitte’s 2026 US Health Care Outlook, that road has reached a dead end.

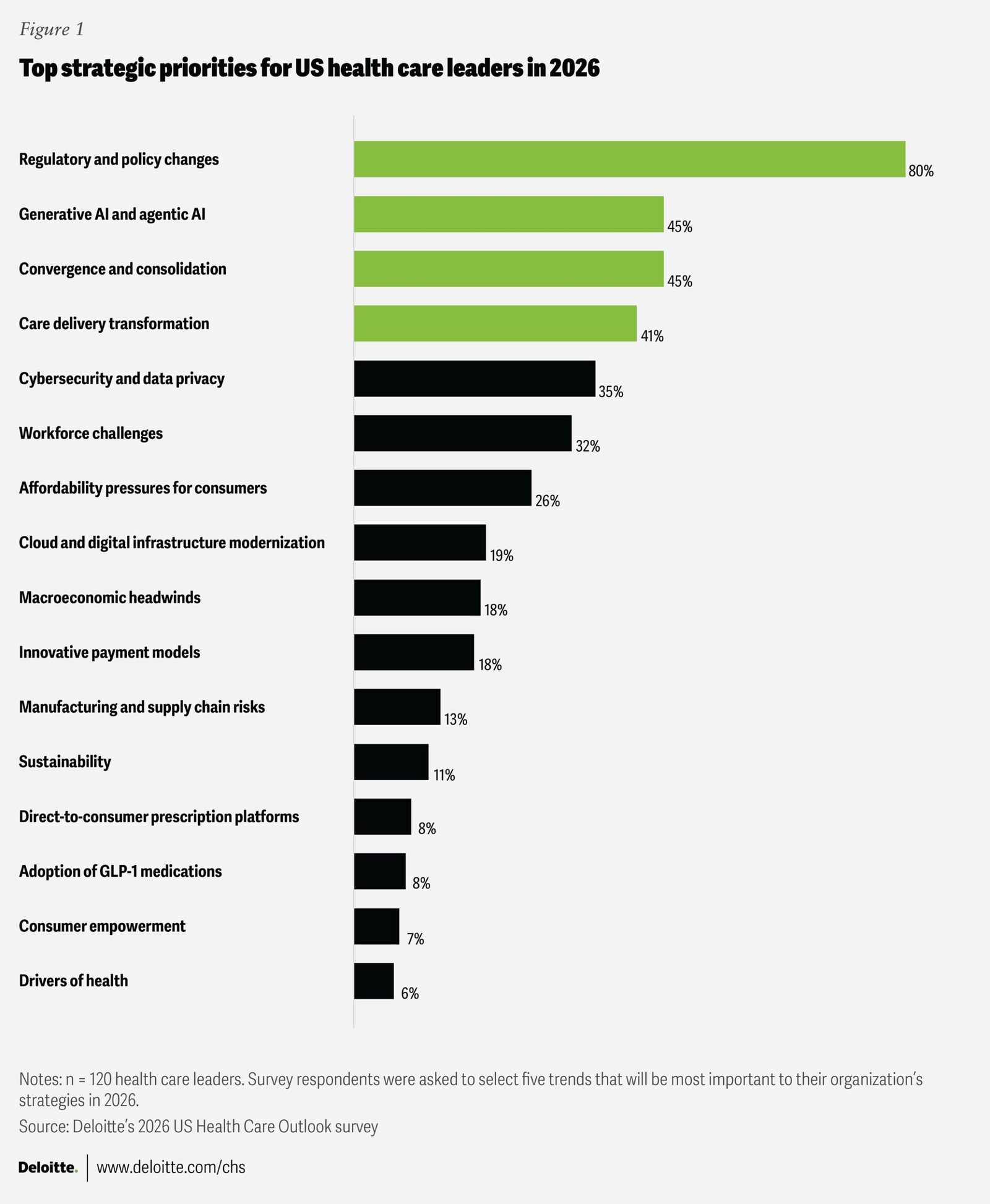

In a survey of 120 C-suite executives across major health systems and plans, a paradox emerged. More than two-thirds of leaders expect their organizations to outperform the competition in 2026. Yet, the strategies they plan to use—expanding market share and minimizing revenue loss—are fundamentally misaligned with the tsunami of industry uncertainty currently building.

The report serves as a wake-up call: tinkering with the status quo is no longer a viable strategy. With 43% of leaders reporting uncertainty about the industry’s near-term outlook (a sharp jump from 28% last year), the margin for error has vanished.

Strategy 1: The Digital Consumer is No Longer Optional

The first pillar of Deloitte’s recommended pivot is a radical commitment to digital consumer empowerment. The days of viewing patients as passive recipients of care are over.

With affordability pressures citing as a top concern by 26% of executives, consumers are increasingly shopping for care, delaying visits, or demanding more convenient, tech-enabled options. The report argues that long-term resilience requires meeting these consumers where they live—on their phones. This means moving beyond basic patient portals to create immersive digital experiences that rival retail and banking sectors.

Strategy 2: Scaling AI from “Pilot” to “Production”

Perhaps the most critical technological imperative in the report is the shift regarding Artificial Intelligence. For the past two years, Generative AI has been a sandbox experiment for many systems. In 2026, it must become the engine room.

Deloitte identifies “Scaling generative AI and agentic AI” as a non-negotiable strategy for modernizing operations. Agentic AI—systems capable of taking autonomous actions to achieve goals—represents the next frontier. By automating complex administrative workflows, coding, and even clinical support tasks, health systems can finally break the cost curve that has threatened their margins for a decade.

Strategy 3: The Era of Unlikely Alliances

The final strategy challenges the insular nature of the healthcare industry. Deloitte urges leaders to “join forces with other industries to unlock innovation.”

We are already seeing the early signals of this trend, with retail giants, tech behemoths, and telecom companies entering the care delivery space. For traditional providers and payers, the choice is binary: compete with these agile new entrants or partner with them to unlock new value streams. Whether it’s leveraging a tech partner for better data analytics or a retail partner for community access points, the report suggests that the most successful health organizations of 2026 will be part of broader, cross-sector ecosystems.

For more information about the report, visit https://www.deloitte.com/us/en/insights/industry/health-care/life-sciences-and-health-care-industry-outlooks/2026-us-health-care-executive-outlook.html